|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Refinance a House: Essential Considerations and StepsRefinancing a house can be a smart financial move if done correctly. It allows homeowners to adjust their mortgage terms, potentially lowering monthly payments or reducing interest rates. However, the process involves several key considerations to ensure it aligns with your financial goals. Understanding the Basics of RefinancingRefinancing involves taking out a new loan to pay off the existing mortgage. This can be beneficial if the current interest rates are lower than your original loan or if you wish to change the loan term. When to Consider Refinancing

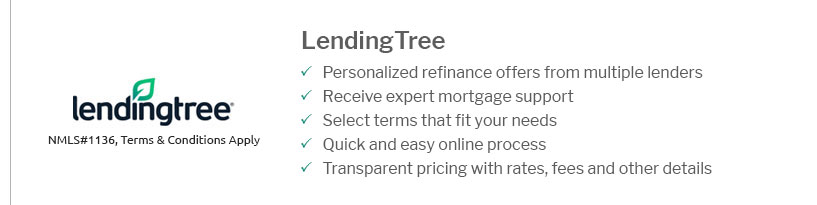

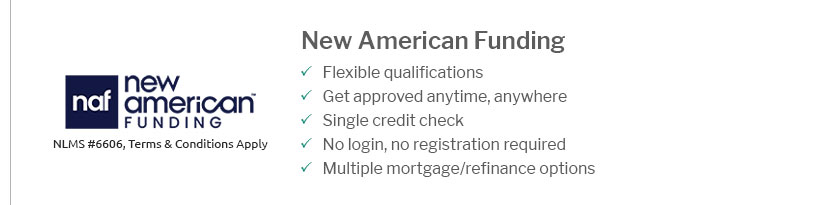

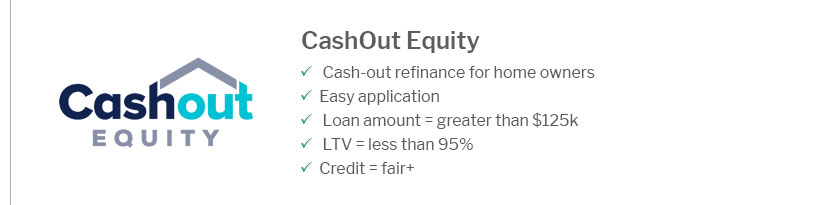

Steps to Refinance Your HomeEvaluate Your Financial SituationStart by assessing your current financial status, including your credit score, existing mortgage terms, and home equity. This will help determine if refinancing is a viable option. Research Different LendersShop around for lenders to compare rates and terms. You may find that a lender offers better terms for those with fair credit. For more information, consider visiting refinance mortgage with fair credit. Apply for a New Loan

Close the LoanOnce approved, you'll sign the final documents and pay any closing costs. This step finalizes the refinancing process and starts your new loan term. Key Considerations When RefinancingIt's crucial to weigh the potential savings against the costs associated with refinancing. Cost of Refinancing

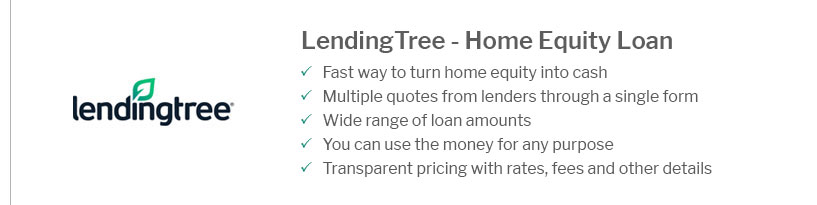

If you have significant home equity, you might explore a home equity loan option. Learn more at refinance mortgage with home equity loan. Frequently Asked QuestionsWhat are the benefits of refinancing a house?Refinancing can lower your monthly mortgage payments, reduce your interest rate, or change your loan terms. It can also provide access to home equity for expenses like renovations. How does my credit score affect refinancing options?A higher credit score typically qualifies you for better interest rates and terms. If your score has improved since you took out the original mortgage, refinancing could be beneficial. Are there any downsides to refinancing?Potential downsides include closing costs, which can be significant, and the extension of the loan term, which might result in paying more interest over time. https://www.chase.com/personal/mortgage/education/owning-a-home/refinance-your-home

A mortgage refinance involves switching your old mortgage to a new one, usually with different rates and terms, that's ideally more favorable for your ... https://www.nerdwallet.com/article/mortgages/how-to-refinance-your-mortgage

A mortgage refinance replaces your current home loan with a new one. Often, people refinance to reduce their interest rate, cut their monthly payments or tap ... https://www.ncsecu.org/resources/learn/how-to-refinance.html

If you're looking to lower your monthly payments, shorten the term of your loan, or access cash for a big life expense like a home improvement project, ...

|

|---|